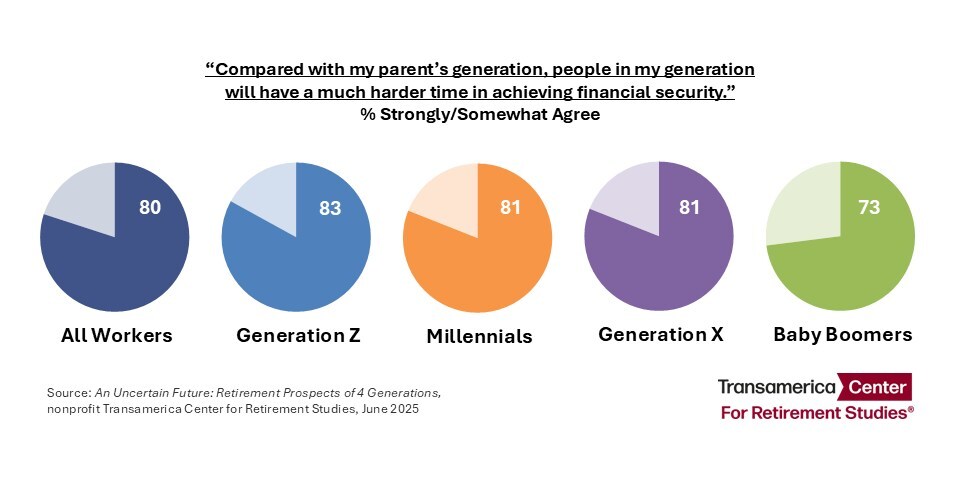

Eight in 10 U.S. workers believe their generation will have a much harder time achieving financial security compared to their parents, according to a new survey that reveals widespread anxiety about retirement prospects across all age groups.

The research from Transamerica Center for Retirement Studies shows Generation Z through Baby Boomers are all struggling with retirement preparation amid economic uncertainty, caregiving responsibilities, and fears about job security.

“The single most important ingredient for workers to achieve a financially secure retirement is access to meaningful employment with retirement benefits throughout their working years,” said Catherine Collinson, CEO and president of Transamerica Institute and TCRS. “Amid workforce transformations and the evolving retirement landscape, resilience is imperative. Workers must have the know-how and resources needed to navigate an uncertain future.”

Generation Z faces burnout while caring for elders

The youngest workers in the survey face unique pressures, with 59% reporting they often feel exhausted and burnt out. Nearly one-third hold multiple jobs while 59% maintain side hustles to supplement income.

Many Generation Z workers are already serving as caregivers for relatives or friends, with 41% taking on these responsibilities during their careers. Among these caregivers, 90% have made work adjustments ranging from missing days to quitting jobs entirely.

Despite competing financial priorities, 76% of Generation Z workers are saving for retirement through workplace plans or personal accounts. They started saving at age 20 and currently contribute 15% of their annual pay to retirement plans.

However, their savings remain modest with $31,000 in total household retirement accounts and only $2,000 in emergency savings. One in four have already tapped retirement savings through hardship withdrawals.

Millennials juggle debt and family obligations

Millennial workers face their own financial squeeze, with 58% still recovering from pandemic impacts and 49% struggling to make ends meet. Debt interferes with retirement savings for 59% of this generation.

Like Generation Z, 41% of Millennials serve as caregivers, typically for parents, with 89% making employment adjustments as a result.

Millennials have accumulated $65,000 in retirement savings and $5,000 in emergency funds. They contribute 10% of annual pay to retirement plans but started saving later at age 26.

Generation X approaches retirement behind on savings

Generation X workers, who begin turning 60 this year, show concerning confidence levels about retirement readiness. Only 18% are very confident they can fully retire comfortably, and just 23% strongly agree they’re building adequate savings.

Many plan to work past traditional retirement age, with 39% expecting to retire at 70 or older or never retire at all. More than half plan to continue working during retirement.

Generation X workers have saved $107,000 in retirement accounts with $6,500 in emergency savings. They expect to rely primarily on self-funded savings rather than Social Security, with 77% concerned Social Security won’t be available when they retire.

Only 25% have written retirement strategies.

Baby Boomers extend working years

Baby Boomer workers are pushing retirement boundaries, with 57% expecting to work until age 70 or beyond. Their top retirement fears include declining health requiring long-term care, outliving savings, and Social Security reductions.

This generation has accumulated the most savings at $270,000 in retirement accounts and $20,000 in emergency funds, though only 27% have written financial strategies and 38% have backup income plans.

Widespread concerns about retirement adequacy

Across all generations, 68% of workers fear they won’t save enough for retirement even if they work until traditional retirement age. Despite 58% preferring professional guidance for retirement savings, only 35% currently use financial advisors.

The survey reveals a knowledge gap, with just 22% of workers claiming substantial personal finance knowledge.

“The strength of the U.S. retirement system relies on a robust economy, labor force, and employment market – an environment that is conducive for workers to earn income and save for the future,” said Collinson. “With today’s accelerating pace of change, policymakers can help ensure that workers don’t get left behind.”

The research calls for policy support to address Social Security and Medicare funding issues while making it easier for employers to provide retirement benefits.

The study surveyed 5,493 workers in for-profit companies between September and October 2024, including representatives from all four generations. The data was weighted for demographic factors and carries a margin of error of 1.7 percentage points.